Where Have All The Houses Gone?

Courtesy of The New York Times, March 5th, 2021

The inventory of homes for sale is startlingly low. The pandemic is part of the reason, but it’s not the whole story.

Much of the housing market has gone missing. On suburban streets and in many urban neighborhoods, across large and midsize metro areas, many homes that would have typically come up for sale over the past year never did. Even in cities with a pandemic glut of empty apartments and falling rents, it has become incredibly hard to buy a home.

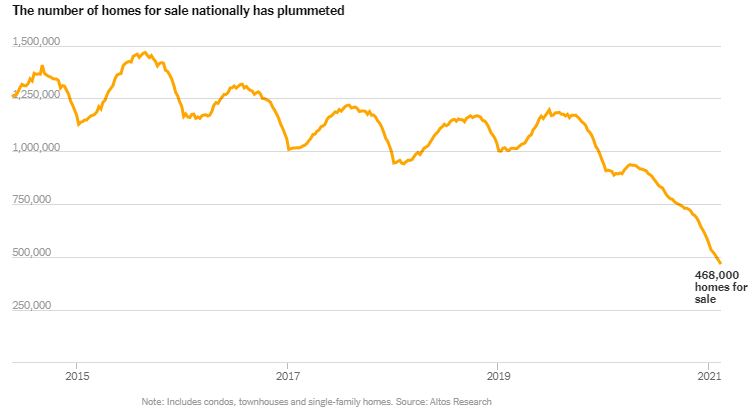

Today, if you’re looking for one, you’re likely to see only about half as many homes for sale as were available last winter, according to data from Altos Research, a firm that tracks the market nationwide. That’s a record-shattering decline in inventory, following years of steady erosion.

And it’s one flashing sign that the housing market — which can defy basic laws of economics even in normal times — is acting very, very strangely.

This picture is a product of the pandemic, but also of the years leading up to it. And if half of what is happening in the for-sale market now seems straightforward — historically low interest rates and a pandemic desire for more space are driving demand — the other half is more complicated.

“The supply side is really tricky,” said Benjamin Keys, an economist at the Wharton Business School at the University of Pennsylvania. “Who wants to sell a house in the middle of a pandemic? That’s what I keep coming back to. Is this a time you want to open your house up to people walking through it? No, of course not.”

A majority of homeowners in America are baby boomers or older — a group at heightened risk from the coronavirus. If many of them have been reluctant to move out and downsize over the past year, that makes it hard for other families behind them to move in and upgrade.

There are lots of steps along the “property ladder,” as Professor Keys put it, that are hard to imagine people taking mid-pandemic: Who would move into an assisted living facility or nursing home right now (freeing up a longtime family home)? Who would commit to a “forever home” (freeing up their starter house) when it’s unclear what remote work will look like in six months?

This reluctance can take on a life of its own in a tight market, said Ralph McLaughlin, the chief economist at Haus, a housing finance start-up. When there aren’t a lot of options out there to buy, would-be sellers get skittish about finding their own next home and back out of the market themselves.